NAVI Protocol

NAVI Protocol is the first Native One Stop Liquidity Protocol built on SUI, which offers over collateralized lending/borrowing for SUI, USDC, USDT, wETH and wBTC.

NAVI Protocol - The premier liquidity protocol on Sui blockchain.

In the rapidly expanding world of the Sui blockchain, Navi Protocol (navi protocol) has emerged as the premier liquidity protocol, driving capital efficiency and enabling a new era of decentralized finance (DeFi). As the first native one-stop liquidity platform on Sui, Navi combines lending, borrowing, and liquid staking into a seamless ecosystem. Whether you are looking to stake your assets, secure a loan, or simply maximize your yield, Navi Protocol offers a secure and robust platform designed to meet the needs of both retail users and institutions.

What is Navi Protocol - Sui Liquidity Protocol?

NAVI Protocol - One Stop Liquidity Platform on Sui.

Navi Protocol (navi sui) is a modular DeFi infrastructure that serves as the liquidity engine for the Sui chain. By leveraging Sui's unique object-centric architecture, Navi provides users with a highly efficient and transparent way to manage their assets. The protocol is backed by leading investors and has seen its total value locked (TVL) grow significantly as more users flock to the network.

At its core, Navi Lending (navi lending) allows users to supply liquidity to the market and earn passive rewards. Conversely, borrowers can obtain over-collateralized loans, unlocking the value of their assets without selling them. This system is powered by advanced smart contracts that automate transactions and ensure security in real time. Navi Protocol also incorporates robust risk management practices to protect both users and the protocol, especially when utilizing isolated pools and lending features.

Key Features of Navi Protocol: Isolated Pools and Capital Efficiency

One of the standout features of Navi Protocol is its innovative use of isolated pools. Unlike traditional shared pools where risk is spread across all assets, an isolated pool allows for the listing of newer or more volatile assets with contained risk. The collateral factor in each isolated pool determines how much users can borrow against their deposited assets, directly impacting their borrowing power. This design ensures that the insolvency of one asset does not threaten the entire protocol, ensuring a higher level of safety for lenders.

Simultaneously, Navi focuses on capital efficiency. By allowing users to use Liquid Staking Tokens (LSTs) as collateral, the platform enables leveraged staking strategies. This means users can stake their Sui tokens, receive LSTs, and then use those LSTs to borrow more Sui, effectively compounding their rewards.

Navi DEX: The Gateway to Swaps

While primarily known for lending, the ecosystem also integrates Navi DEX (navi dex) capabilities through its aggregator, often referred to as Astros. This feature aggregates liquidity from various sources across the Sui chain, providing users with the best possible trading rates. Users also benefit from competitive swap fees when trading through the aggregator. By reducing slippage and optimizing trade routes, Navi ensures that users get the most out of every transaction.

Use Cases and Applications of Navi Protocol

NAVI Protocol stands out as a versatile liquidity protocol on the Sui blockchain, offering a wide variety of use cases and applications tailored to both new and experienced DeFi users. At the heart of its design is the isolated pool feature, which allows users to manage their assets and debt positions independently. This approach not only enhances capital efficiency but also provides a safer environment for experimenting with different asset types and strategies.

Through advanced smart contracts, the protocol dynamically adjusts interest rates in real time, optimizing returns for users based on current market conditions. This ensures that both lenders and borrowers benefit from the most competitive rates available, maximizing the potential rewards for those who stake their assets. By allowing users to participate in lending and liquid staking derivatives (LSDeFi) without sacrificing liquidity, NAVI enables users to earn rewards while keeping their assets accessible.

With a total value locked (TVL) of over $422 million, NAVI Protocol has established itself as a critical player in the Sui ecosystem. The platform is designed to make lending and borrowing top assets seamless and secure, ensuring that users can trust the protocol with their funds at all times. Whether you are looking to stake, lend, or explore new DeFi applications, NAVI offers a robust suite of features designed to help users unlock the full potential of their assets.

The NAVX Token: Governance and Utility on Navi protocol

NAVX Token - Governance and Utility Token of NAVI Protocol.

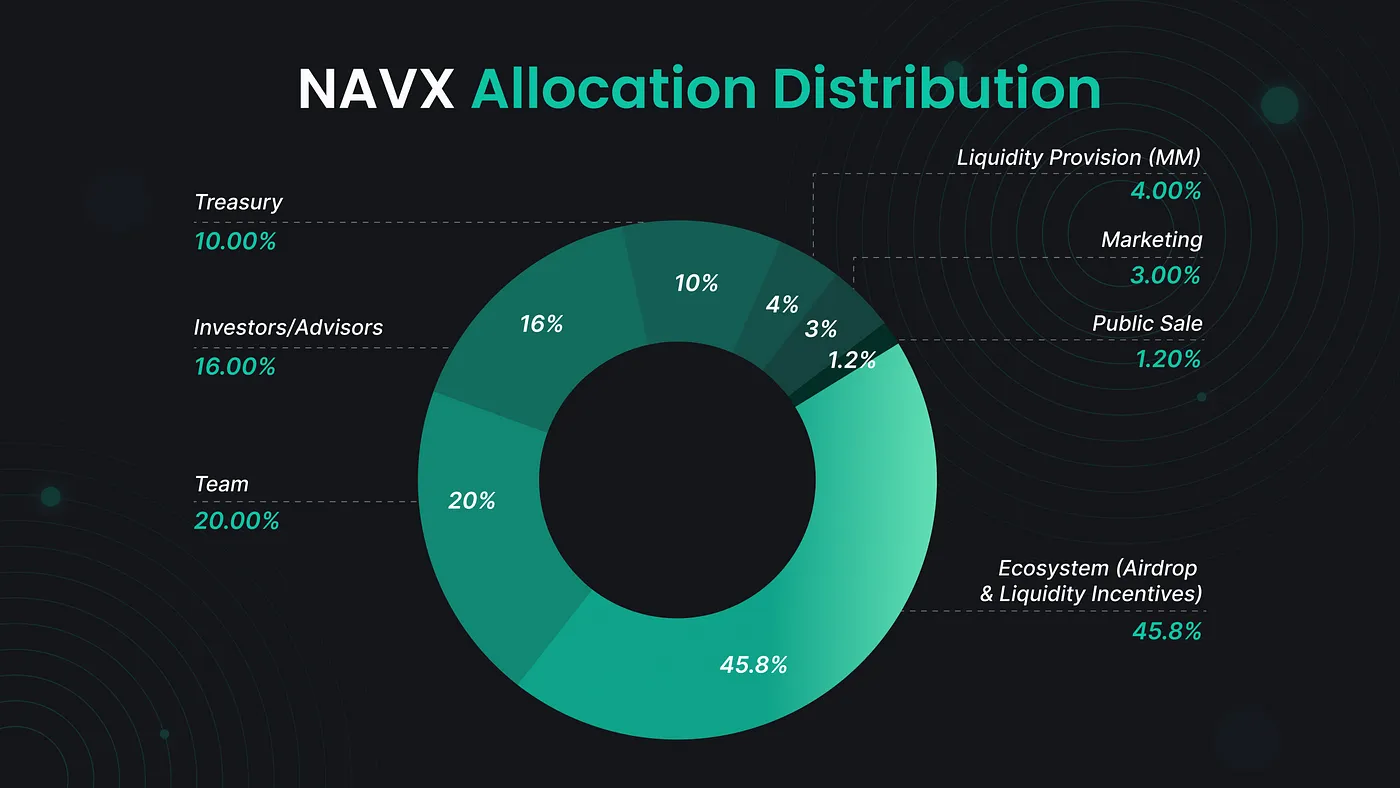

The native utility token of the ecosystem is NAVX (navi crypto). As of late 2025, the circulating supply of NAVX plays a critical role in the governance of the protocol. Holders of NAVX can vote on proposals that shape the future of Navi, from fee structures to new asset listings.

The tokenomics of NAVX are structured to support both governance and utility, ensuring that incentives align with the protocol's long-term growth and community participation.

The community sentiment remains bullish on NAVX, driven by its expanding utility. Incentives are designed to reward long-term supporters; users can earn NAVX as rewards for supplying liquidity or borrowing assets. Tracking the price and data of NAVX in real time reveals a token deeply tied to the health and growth of the Sui ecosystem.

Security and Partnerships: Navi SafePal Integration

Security is paramount in DeFi. Navi Protocol has undergone rigorous audits and has published an audit report to demonstrate its smart contracts are secure. Furthermore, strategic partnerships have expanded its reach. For instance, Navi SafePal (navi safepal) integration allows users to access Navi's features directly through their SafePal wallets. This hardware and software wallet integration adds an extra layer of safety, ensuring that users can manage their positions and stake their assets with peace of mind.

Ecosystem and Community

NAVI Protocol Ecosystem - Powered by leading investors and a vibrant community.

The strength of the NAVI Protocol ecosystem lies in its robust backing and vibrant community. Supported by leading investors such as OKX Ventures, Hashed, DAO5, and Mechanism Capital, the protocol is well-positioned for sustained growth and innovation. This backing not only adds credibility but also fuels the development of new features and applications, further increasing the platform's total value.

Community engagement is a cornerstone of the protocol, with a variety of incentives and rewards designed to encourage active participation. Users who provide liquidity, participate in governance, or contribute to the ecosystem are rewarded, ensuring that the community has a direct stake in the protocol's success. The governance feature empowers more users to influence key decisions, making NAVI a truly community-driven platform.

With a circulating supply of 820 million NAVX tokens, the community's involvement is both significant and impactful. The NAVI team is dedicated to maintaining a secure, transparent, and inclusive environment, prioritizing security and real-time responsiveness in every aspect of the platform. Built on the scalable and secure Sui blockchain, NAVI enables fast, reliable transactions and fosters a thriving ecosystem for lending, borrowing, and staking assets.

As NAVI Protocol continues to evolve, it is designed to attract more users and developers, expanding its reach and increasing its total value. The combination of strong governance, community incentives, and a secure platform makes NAVI an attractive choice for anyone seeking a rewarding and reliable DeFi experience on Sui.

Looking Ahead: January and Beyond

Since its inception, Navi has followed a rigorous roadmap. Looking back at Jan (January), the protocol often releases major updates or incentives to kickstart the year. As we look toward the next Jan, the community anticipates further expansions, including potential cross-chain applications and deeper integrations with real world assets.

The platform is constantly evolving, offering a variety of features that cater to every kind of investor. Whether you are a conservative lender seeking stable yields or a degenerate farmer looking for high rewards, Navi has a pool for you.

Conclusion

Navi Finance (navi finance) has established itself as a cornerstone of the Sui blockchain. By combining an isolated pool model with high capital efficiency and a user-friendly interface, it is enabling the next generation of DeFi. With a growing circulating supply of NAVX and a bullish community, Naviprotocol is poised to capture even more total value in the coming years. For anyone looking to lend, borrow, or stake on Sui, Navi lend sui solutions offer a premier, time-tested, and secure gateway to financial freedom.